Your Digital Identity & 4 Ways to Protect It

.png?sfvrsn=d0d8421b_1)

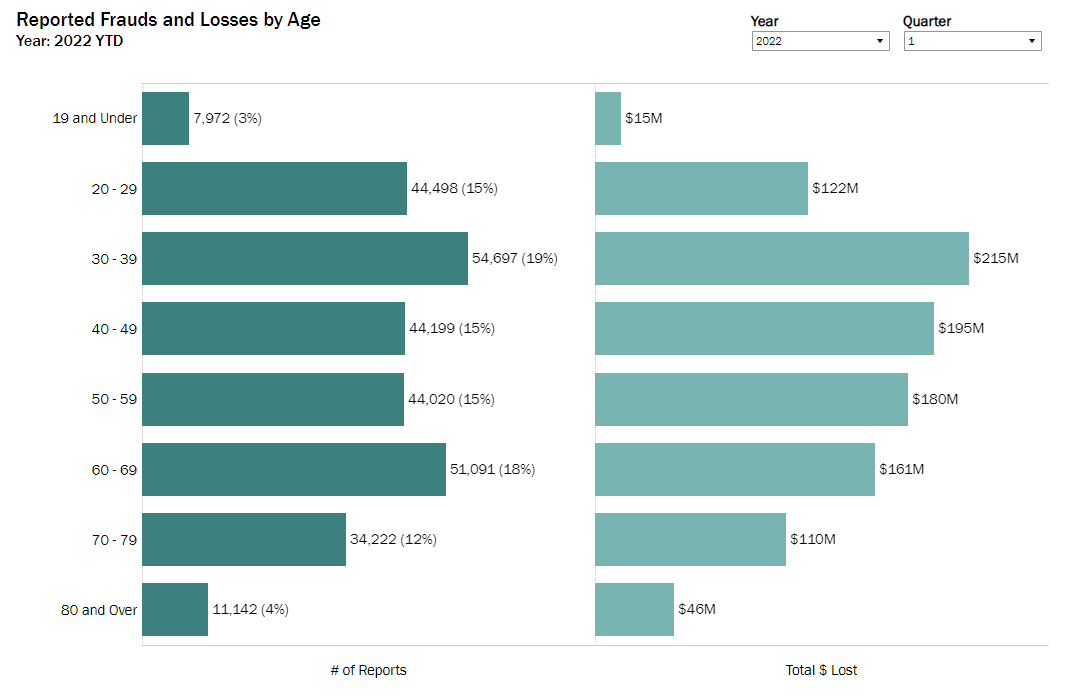

Consumers reported losing more than $5.8 billion to fraud in 2021, up more than 70 percent from 2020, according to the Federal Trade Commission. What might surprise you when looking at these losses is the division by age, with ages 30-39 reporting the most loss of any age group last year at $598 million. In the first quarter of this year, the 30-39 group accounted for almost 20% of total fraud reports (nearly 55K) with $215 million already reported lost.

While Seniors are often thought of as the biggest targets for fraud and identity theft, it is time for digital natives (those raised in the age of computers and the internet) to realize they are not immune to fraudsters’ increasingly sophisticated scams. From social media platforms to peer-to-peer payments, young adults may be trading their security for convenience, and companies are having to find new and more complex ways to verify that your digital identity matches your real-world one.

What is a digital identity?

Your digital ID is all the information available online about you. There are two layers to this:

- Digital Attributes – Your personally identifiable information (PII) including your social security number, date of birth, driver’s license number, email address, biometrics (fingerprint, face ID), and login information (usernames and passwords)

- Digital Activities – Online behavioral patterns such as your purchase history, activity on social media, location tracking data, and search history

Each of these pieces of information can be helpful to a hacker in getting into your accounts, and with the right combination, you could end up the victim of theft or fraud.

How can you protect your digital identity?

Create strong passwords and change them regularly. Though this one is repeated often, it involves a lot of time and effort to maintain. This is where a password manager comes in. Not only can they generate, change, and manage all your passwords, alleviating a lot of hassle, but they can also alert you of data breaches.

Use multi-factor authentication when available. Multi-factor authentication (MFA) goes beyond just a username and password and requires two or more factors to gain access to a website or app. This ensures security even if one of the factors is compromised.

Most MFA processes combine several types of authentication factors including:

- Something you know – A password or pin number

- Something you have – Sending an authentication code to a device you possess

- Something you are – Running biometrics like a fingerprint scan, voice or face recognition

- Where you are – Verifying your location before granting access

Audit your privacy settings and be careful what you post. People often use things like their birthday, kids’ names, pets’ names, or favorite college mascots in their passwords. Other tidbits such as your mother’s maiden name, the make of your first car, or the name of your first school can answer common security questions. This information is easy for fraudsters to find on social media. Keep your posts visible only to people you know and trust, and when in doubt, don’t share personal information online.

Inquire about how your information is being shared. Beyond social media, research how institutions and applications are sharing your data. Did you know some popular payment apps display who you’re sending money to and receiving payments from to your friends or even publicly? This gives hackers great insight into your contacts and routines. Southern First clients, remember that you can send and receive money safely with Zelle®, right from our personal banking mobile app.

As a Southern First client, you can rest assured that any information you have shared with our bank is secure, and we take every measure to protect your identity. For more information, view our Privacy Policy here, and don’t hesitate to reach out to your banker with questions.

.png?sfvrsn=4583b53d_0)